Spurred on by necessity and convenience, digital transactions make up an ever-increasing share of our day-to-day business. We’re all managing our shopping, finances, and even our healthcare online, but the downside of this shift is that it has created countless new opportunities for cybercriminals to steal and manipulate our personal data.

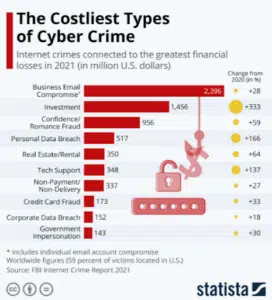

Globally, the cost of cybercrime is expected to hit $8 trillion annually in 2023. Bad actors are always looking for newer, more sophisticated ways to breach systems and exploit sensitive data for fraudulent gains. Businesses and consumers must be perpetually on guard for phishing attacks, malware, identity theft, SIM swapping, and other forms of cybercrime. It can be challenging to stay ahead of the latest tools and tactics. Even seasoned, well-protected telecom companies like T-Mobile can fall victim to hackers.

While many businesses treat fraud prevention and cybersecurity as separate concerns, it’s important to remember that data breaches and fraud go hand in hand for cybercriminals. Understanding one side of this equation can give you critical insights into the methods of the other. In this post, we’ll show you how fraud analytics can play a crucial role in helping businesses protect their data, minimize financial losses, and maintain the trust and confidence of their customers.

What is Fraud Analytics, and Why is it Important?

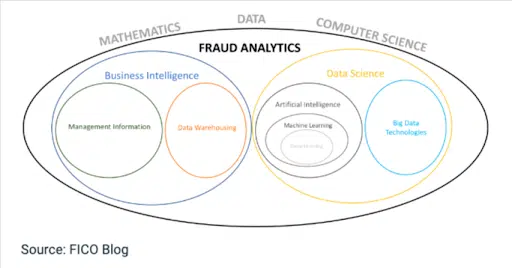

Fraud analytics is the process of leveraging big data to gain insights into the online fraud attacks that target your business. Analyzing the relevant data can tell you where the attacks are coming from, how they’re getting through your defenses, and what you can do to prevent them more effectively.

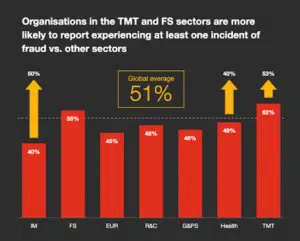

In both the public and private sectors, organizations of every size and industry are targeted by cybercriminals and fraudsters. Because of their valuable data, businesses in industries like finance, manufacturing, healthcare, and pharmaceuticals can be particularly vulnerable.

Online fraud can be the end result of many different types of cyberattacks. For example:

- Social engineering and phishing attacks rely on deception to get their targets to give up login credentials and other sensitive information.

- Account takeover attacks use stolen credentials to gain unauthorized access to customer or employee accounts.

- SIM swapping attacks trick mobile carriers into giving fraudsters access to a victim’s phone.

- Malware programs execute hostile commands on the target’s computer system.

- Man-in-the-Middle attacks in which the cybercriminal eavesdrops on communications between a client and host to steal information or impersonate one of the parties.

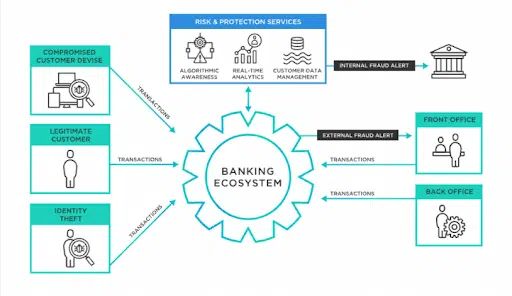

Once the cybercriminal has gained access to a victim’s account or financial information, they can engage in identity theft, make unauthorized payments, or sell the compromised data on the dark web. Fraud analytics can identify the types of attacks that are taking place and which vulnerabilities they’re successfully exploiting.

Benefits of Fraud Analytics

The most effective and pernicious cyberattacks take place without the target’s awareness. You only realize you’ve been victimized once the results (such as leaked data or financial loss) are discovered. Some cyberattacks can go undetected for years. Fraud analytics helps you detect and prevent attacks proactively instead of reacting to them after the fact.

Fraud analytics take data sets from a variety of sources and channels—transactions, traffic logs, customer records, social media—ensuring that you have a broad overview of every possible vector of attack, whether it’s a sophisticated software exploit or an old-fashioned social engineering scheme.

Using advanced statistical analysis techniques and state-of-the-art AI and machine learning technology, fraud analytics can identify the subtle patterns of behavior associated with fraud. It creates predictive models that give you the best chance of catching and stopping attacks before they cause significant harm.

How Using Analytics Prevents Fraud

Customers and end users aren’t accessing online sites through a single web portal anymore. They’re logging in from a variety of different devices and locations, and cybersecurity protocols need to be able to gel with the way people actually engage with digital services.

Passwords are easily compromised and are no longer sufficient to fully secure an account. However, challenging users with increasingly strict authentication methods can be off-putting and cause undesirable friction.

Fraud analytics help stop cybercrime by giving businesses the ability to proactively prevent attacks. By using the power of big data to assess risk and model threats, you can reject transactions and login attempts from bad actors without disrupting the user experience for trusted parties.

Where Fraud Analytics Meets Cybersecurity

Despite the clear relationship between fraud prevention and cybersecurity, many organizations maintain separate units for these functions.

Cybersecurity focuses on systemic, technological solutions designed to secure networks and devices against intrusion. Fraud prevention deals with the misuse of data that has already been compromised, and often encounters attacks that bypass technological defenses by relying on deception and manipulation.

By integrating these two functions and allowing them to share data, you make it possible for both teams to benefit from each other’s perspectives and develop more robust defenses. Joint training sessions can help bridge the knowledge gap and facilitate more effective collaboration.

7 Ways to Use Fraud Analytics for Better Cybersecurity

1. Use machine learning to improve fraud prevention algorithms

With AI and machine learning, the more data your analytics engine processes, the smarter it gets. Over time, you can predict fraud with greater accuracy and detect subtler fraud indicators.

2. Apply a “fraud score” to events and transactions

Fraud scoring is a widely-used technique that assigns point values to various fraud indicators and scores the risk level of any given interaction by adding up its point total. You can then establish thresholds that reject or challenge users based on the fraud score of whatever they’re trying to do.

3. Blacklist suspicious accounts and traffic sources

Analytics can pinpoint the variables that are consistently associated with fraud, empowering you to take decisive action to preemptively block users and transactions that carry an unacceptably high level of risk.

4. Monitor user accounts continuously

Just because users pass your authentication protocols and log in successfully doesn’t mean they’re safe. Accounts can be compromised with stolen credentials, and accounts belonging to malicious parties can remain innocuous for a long time before their owners make a move. It pays to monitor and analyze account data throughout its entire lifecycle, but be mindful of any applicable data protection or privacy regulations.

5. Analyze social networks

Cybercriminals work in teams, influence each other, and share information. Analyzing the connections between users, accounts, and traffic referrals can bring these associations to light and identify potential fraudsters who might otherwise fly under the radar until it’s too late.

6. Encourage your teams to share their resources

Siloed data is underutilized data, and in an organization working toward common goals, there’s no reason to hoard information. Furnish your teams with account management platforms that offer high-level overviews, data integration, and collaboration tools, and ensure they have many opportunities to pool their resources and exchange ideas.

7. Set up joint training activities

One highly effective way to keep your fraud and cybersecurity teams on the same page is to provide joint training sessions that encourage interaction and knowledge-sharing. Fraud analytics will reveal many areas of mutual concern to these teams and highlight the importance of ensuring everybody receives the same information and guidance.

Bringing It All Together with Cybersecurity Awareness Training

Online fraud is a subset of the larger problem of cybercrime and a motivating factor behind a significant percentage of attacks. As such, analyzing fraud data can almost always produce valuable insights into the nature and scope of cybercrime. Fraud prevention and cybersecurity teams can learn from each other and collaborate to develop more effective solutions to protect the integrity of the organizations they serve.

One of the best ways to foster an organizational culture that works together to solve these problems is to install a cybersecurity mindset with security awareness training.

Request a demo today to see how an engaging, personalized training program from CybeReady can have a measurable impact on reducing fraud and cyberattacks for banks and other financial service organizations.