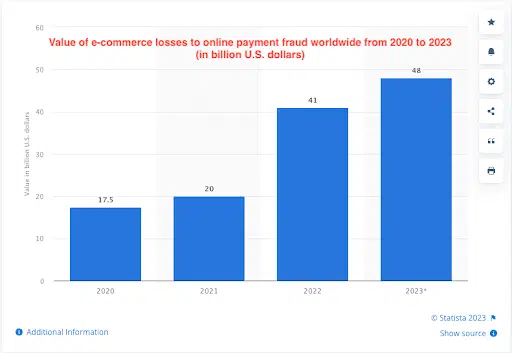

Payment fraud affects many industries, but finance, pharmaceuticals, and manufacturing are particularly vulnerable. It’s vital for info/cybersecurity team leads/ managers, CISOs, Heads of IT, and IT managers to be aware of the current state of payment fraud, its costs, and how it can be prevented using the right fraud management tools.

According to the 2022 AFP Payments Fraud and Control Survey, 71% of organizations reported falling victim to payment fraud in 2021. B2B payment fraud is also a significant issue, with a shocking 98% of B2B firms reportedly experiencing attacks in 2021, costing approximately 3.5% of their annual revenue.

Fraud management tools are essential for businesses to prevent payment fraud. These tools are designed to detect, prevent, and mitigate fraudulent activities. In this post, we will look closely at fraud management tools, detail their benefits and features, and survey the top ten fraud management tools available.

What are fraud management tools?

Fraud management tools are software solutions that identify, prevent, and mitigate fraudulent activities. They use advanced algorithms and machine learning to detect fraudulent activities and suspicious patterns. These tools are used to protect against various types of fraud, including identity theft, account takeover, transaction fraud, and application fraud.

Types of Fraud Management Tools

There are several different types of fraud management tools available in the market:

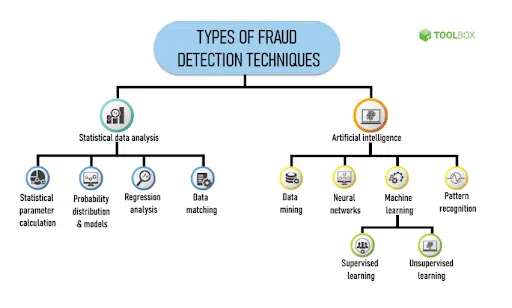

- Rule-Based Systems – Rule-based systems use predefined rules to detect fraudulent activities. These rules are based on historical data and identify suspicious patterns. Rule-based systems are less effective than other fraud management tools because they can only identify fraud patterns that have occurred before.

- Anomaly Detection – Anomaly detection tools use machine learning algorithms to detect unusual activities or patterns that deviate from the norm. These tools are more effective than rule-based systems because they see new and previously unseen fraud patterns.

- Artificial Intelligence (AI) and Machine Learning (ML) – AI and ML-based fraud management tools are the most effective because they can identify new fraud patterns and continuously learn from new data.

Benefits of Fraud Management Tools

Fraud management tools offer several benefits to businesses, including:

- Reduced financial loss

- Enhanced customer trust

- Increased efficiency in detecting and handling fraud incidents

- Compliance with regulations such as PCI-DSS and GDPR

- Improved decision making

- Improved brand reputation

- Cost savings and increased revenue when fraud, chargebacks, and refunds are prevented

4 Key Features of Fraud Management Tools

The essential components of fraud detection software encompass a wide range of functionalities, from preventing chargebacks to verifying identities. Here are four key features that are indispensable:

1. Risk Rules

Risk rules enable you to sort through user behavior based on the information you have at hand. A basic risk rule could be: “If the login attempt is associated with an IP address belonging to a VPN, block it.”

2. Risk Scoring

Advanced systems allow you to manipulate scores and thresholds, providing you with a measure of the level of risk associated with an action. For instance, if a customer’s payment card is not from the same country as their location, you can increase their risk score by 5 points.

3. Real-time Monitoring

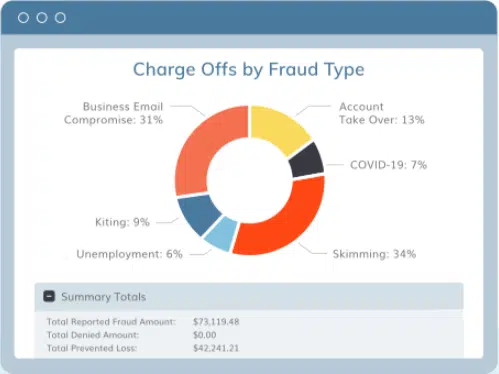

Depending on your requirements, your fraud detection software must be capable of scrutinizing payments on your site to avoid chargebacks or to comply with anti-money laundering regulations. For identity verification and account protection, you should also be able to halt suspicious activity before it escalates promptly.

4. Machine Learning Engine

As you may need to analyze vast data, the most effective fraud prevention software includes a machine learning algorithm that utilizes your historical business data to propose risk rules. Bonus points if it’s a transparent system that allows you to comprehend the rationale behind the risk rules.

Top 10 Fraud Management Tools

1. Abrigo BAM+

BAM+ by Abrigo is a robust software solution for anti-money laundering (AML) that offers a centralized platform to manage, streamline, and report on all aspects of your program. This tool provides a range of features, including end-to-end case management, scenario analysis, fraud detection, OFAC and watchlist screening, front-line reporting of questionable activity, customer due diligence, and direct-file CTRs and SARs.

Best for: Small to medium-sized organizations looking for a financial fraud solution

Pricing: Available by contacting the company directly

Review: “The system is user friendly and the support has been good so far. We have a great client success manager who always has gotten the appropriate resources we needed as we encounter issues.”

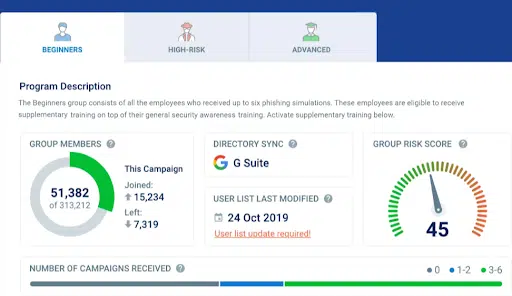

2. CybeReady

Unlike traditional fraud management solutions, CybeReady focuses on creating a culture of security awareness among employees across various industries. CybeReady offers cybersecurity training and awareness programs that are people-centric and designed to adapt to the specific needs of each organization.

Through CybeReady’s training and awareness programs, the company empowers employees at all levels of the organization to identify and prevent fraud, creating an extra layer of security and a shared sense of responsibility for the organization’s security status.

Best for: CybeReady is best suited for organizations of all sizes looking to develop a security-focused company culture.

Pricing: Available upon request

Review: “Great (both proactive and when needed) customer support. Improved employee awareness, reduced number of high-risk users. Effectively addressed compliance, awareness and training-related obligations.”

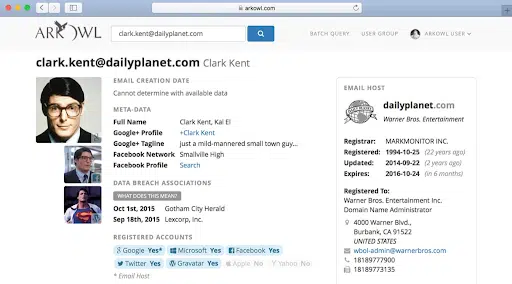

3. ArkOwl

ArkOwl offers a comprehensive analysis tool that mainly focuses on email and phone verification to predict a user’s risk before they make a payment on a website. The analysis is based on several factors, including domain, breaches, and social networks. With 81+ points for analysis, ArkOwl claims to provide raw data with no false positives or negatives.

Best for: Organizations with risk management software in place but are seeking additional knowledge points.

Pricing: Flexible pricing options, including pay-as-you-go and a free demo

Review: “What used to take me 3 minutes back when I was an analyst has been reduced to less than a second.”

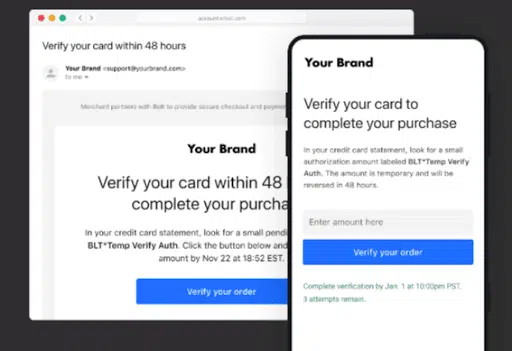

4. Bolt

Bolt is a platform that integrates the best fraud prevention practices with a checkout experience platform to optimize checkout, reduce the time taken for checkout, and maximize store revenue. The system is built on the foundational principle of security and ensures the safety and security of the ecommerce platform and payment gateway.

Best for: E-commerce organizations prioritizing checkout optimization and robust fraud prevention measures.

Pricing: Contact Bolt for pricing details.

Review: “Bolt is being used by our ecommerce sales department. It lets us process credit cards quickly and indemnifies us from fraud.”

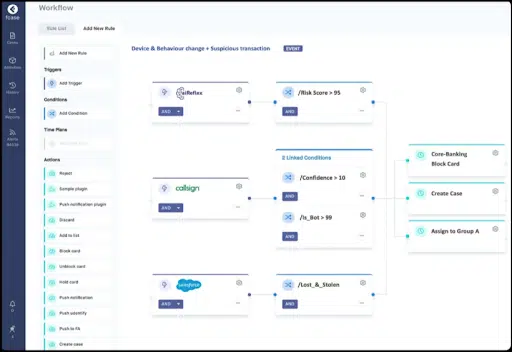

5. Fcase

Fcase addresses the issue of siloed anti-fraud systems by connecting fraud tools and related systems through a single orchestration layer. This combined central fraud layer streamlines fraud operations, manages the customer journey, and improves fraud prevention effectiveness.

Best for: Organizations in the banking, insurance, and financial services sectors who need to manage their fraud operations efficiently.

Pricing: By inquiry through the company’s site

Review: “I like the Fcase tool because it helps me to identify and prevent fraudulent activities. It helps me to detect suspicious activities and take preventive measures to protect my business from fraud.”

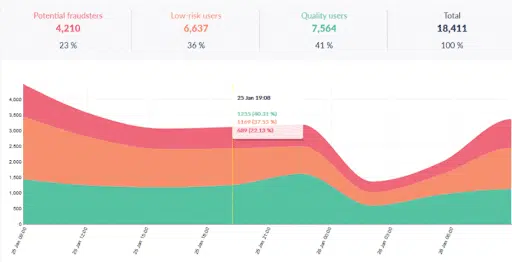

6. FraudHunt

FraudHunt offers a B2B solution that utilizes device fingerprinting technology for anti-fraud purposes. Their service aims to eliminate scammers from your website while optimizing ad budgets and improving website security through accurate user verification and traffic quality analysis.

Best for: Organizations with a lower security budget looking for an affordable anti-fraud solution.

Pricing: Flexible payment options are available, starting at $25 for 25,000 unique users

Review: “It’s one of the most affordable solutions out there and the small investment we’d have to put in purchasing a paid plan would recoup in a month.”

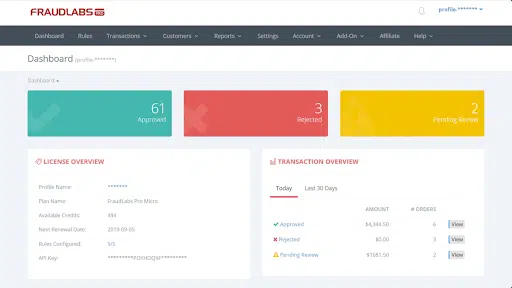

7. FraudLabs Pro

FraudLabs Pro offers a fraud prevention solution to safeguard online businesses from payment frauds, also known as CNP frauds, which can lead to chargebacks or fraud losses. By verifying the authenticity of buyers, it allows legitimate transactions to proceed while blocking fraudulent ones.

Best for: Online merchants or e-commerce sites looking for an affordable solution to payment fraud

Pricing: A free version is available; paid plans start at $29.95 a month

Review: “We are really happy with this fraud labs app. It’s our quick cross check to see if the order is valid. Overall we are very satisfied in the last two years of use and will continue to run and recommend this app.”

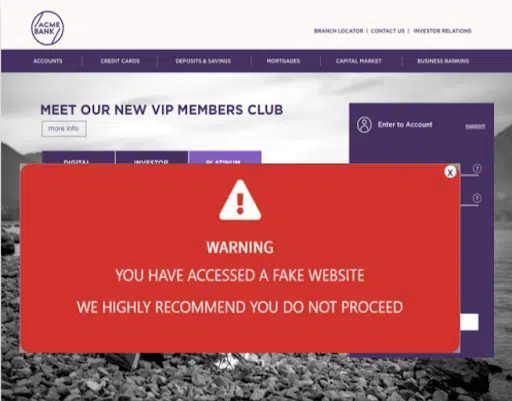

8. Memcyco

Memcyco offers advanced fraud prevention solutions that go beyond traditional corporate security measures. Their cutting-edge technology utilizes machine learning and artificial intelligence to detect and block phishing attempts in real-time, safeguarding end-users, including customers, from fraudulent activities. Memcyco focuses on attacks occurring outside the organization’s security perimeter.

Memcyco’s non-forgeable watermark allows users to confidently differentiate between genuine and fake digital sites without intruding on their online experience. Their solution also provides security and fraud teams with incident response and forensic analysis capabilities, ensuring a comprehensive approach to fraud prevention.

Best for: Businesses and enterprises seeking an all-encompassing cybersecurity solution.

Pricing: Pricing and a free demo is available through the company’s site

Review: “It protects and alerts in real time and provides our donors with a visual security affirmation that they are indeed on our site and not in a forged trap, via an unforgeable watermark on our website and communications and a red alert when accessing a fraudulent website.”

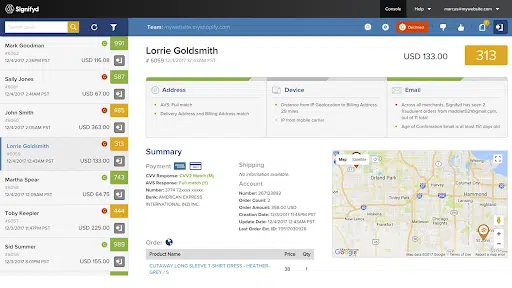

9. Signifyd

Signifyd is a global payment protection platform that focuses on restoring trust between merchants and their customers. By recognizing the true identity and intent behind every payment, Signifyd provides comprehensive fraud prevention for online retailers.

Best for: E-commerce or internet vendors based in the US

Pricing: Get a quote by contacting the company’s sales team.

Review: “Overall it has saved us thousands of dollars and the team has reimbursed us a number of times already for chargebacks on orders they approved. Highly recommended for any US eCommerce vendor.”

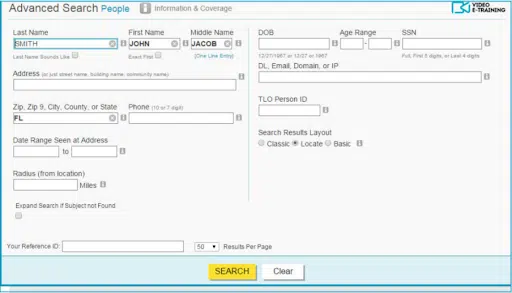

10. TLOxp

TLOxp is a data search and analysis platform that employs proprietary algorithms and supercomputers to sift through massive amounts of public and proprietary data quickly. Users can define search criteria to receive detailed reports with actionable data in seconds, allowing them to take prompt action.

Best for: Organizations in the financial industry

Pricing: Available through the company’s site

Review: “I really enjoy everything about this software. They are always improving it and finding ways to make it easier. They also offer tutorials and videos on how to use it and the best ways to use it.”

Using Awareness as a Prevention Tool

Fraud management tools are essential in detecting, preventing, and mitigating fraudulent activities. But regardless of your chosen solution, implementing a cybersecurity and fraud awareness program concurrently is necessary. Developing a security-conscious culture within your organization instills a shared sense of responsibility among employees and serves as an additional layer of protection for your organization.

Contact CybeReady today to schedule a free demo and discover how you can begin your employee awareness training program.