Credit card fraud has been an issue that has plagued the financial sector for decades. It is a growing problem that doesn’t just affect individuals; large organizations and even financial institutions can become victims of fraud. Fraudsters are constantly finding new ways to compromise sensitive data, so it is essential for organizations, particularly those in the finance, pharma, and manufacturing industries, to be proactive in detecting and preventing fraud.

The Nilson Report reveals that payment fraud at a global level has significantly increased more than threefold, from $9.84 billion in 2011 to $32.39 billion in 2021. Additionally, the Report predicts that losses due to credit card fraud will exceed $43 billion within the next five years. These disturbing statistics highlight the importance of implementing effective measures to prevent credit card fraud and the cost of neglecting to do so.

Credit card fraud detection solutions can help organizations mitigate the risks and losses associated with fraudulent activities. In this article, we will discuss what credit card fraud detection solutions are, their benefits and key features, and provide a detailed listicle of the top ten credit card fraud detection solutions in 2023.

What are credit card fraud detection solutions?

Credit card fraud detection solutions are software tools designed to detect fraudulent activities related to credit and debit card transactions. These solutions use machine learning algorithms and advanced analytics to identify patterns and anomalies in transaction data. They help financial institutions monitor real-time transactions, detect suspicious activities, and prevent fraudulent transactions from being processed.

Types of Credit Card Fraud Detection Solutions

Credit card fraud detection solutions primarily use three different detection systems:

Rule-based Systems

Rule-based systems use predefined rules to detect fraudulent activities. These systems have predefined rules for transactions that are considered suspicious, and any transactions that meet these criteria are flagged for review.

Anomaly Detection Systems

Anomaly detection systems use machine learning algorithms to detect suspicious activities that deviate from normal transaction patterns. These systems analyze past transaction data to identify patterns and create a baseline for normal behavior. Any deviation from this baseline is flagged as suspicious.

Predictive Modeling Systems

Predictive modeling systems use advanced analytics to predict fraudulent activities. These systems use historical data to build models to identify potential fraudulent activities in real-time. They can also generate alerts for specific types of fraudulent activities.

Benefits of Credit Card Fraud Detection Solutions

Credit card fraud detection solutions offer the following benefits to organizations:

- Identify good customers and generate more sales by understanding their shopping behavior and promoting higher-dollar transactions or relevant products.

- Improve approval rates and reduce cart abandonment by controlling fraud risks and implementing proper risk management, which can lead to more revenue.

- Reduce merchant account reserve requirements by minimizing fraud risks and chargebacks to prove that you are less risky to the payment processor.

- Increase processing volume limits by reducing fraudulent transactions to show processors that you are less of a liability.

- Improve customer satisfaction by preventing fraud and protecting customers’ personal information or loyalty points.

- Protect your business’s reputation by avoiding the damage fraud can do to your brand’s image.

- Avoid administrative hassle, chargebacks, and chargeback monitoring programs that can cost you extra fees, fines, and even the loss of payment processing capabilities.

- Retain payment processing capabilities by managing risk metrics and ensuring your business practices don’t increase risks for card brands or payment processors.

6 Key Features of Credit Card Fraud Detection Solutions

When choosing a credit card fraud detection solution, there are six key features to consider:

- Predictive analytics – Institutions collect data to detect fraud patterns and predict future fraud events with an acceptable degree of reliability. Fraud management uses predictive models based on payment transaction data and customer insights to identify and mitigate fraud.

- Experienced fraud analysts – Fraud analysts interpret data and use it to develop automated fraud detection algorithms. Fraud analysts track trends and perform system updates to optimize performance.

- Outlier models – Credit card fraud detection solutions must be able to adjust dynamically to data and use outlier models to detect fraud in emerging markets. Flexible, self-calibrating outlier models change in real-time based on the transaction system to save money.

- Custom rule management – Solutions must accommodate an institution’s policies and practices without inconveniencing cardholders. Custom rule management allows for modifications based on cardholder activity to avoid false positives and keep cardholders confident in using their institution’s card.

- Global profiling – Global profiling helps identify fraud trends initiated in other countries to identify emerging trends and new fraud schemes.

- Mobile card controls – Giving cardholders control over their cards allows them to restrict their card from being used in organizations they don’t frequent, for amounts they wouldn’t charge, and geographic locations they wouldn’t be in. These controls help identify fraud and allow real-time response, increasing brand loyalty.

Top 10 Credit Card Fraud Detection Solutions in 2023

Credit card fraud is a persistent problem for organizations and consumers alike, but fortunately, there are many effective solutions available. Here are the top ten credit card fraud detection solutions for 2023:

1. Accertify

Accertify, an American Express company, is a leading fraud prevention solution provider, offering end-to-end fraud solutions, including customer authentication, SCA optimization, and chargeback management. The key fraud detection component of Accertify Digital Identity utilizes machine learning algorithms to leverage databases of user behavior analytics and device intelligence. Through this approach, Accertify can label users accurately.

Best for: Enterprises that appreciate access to large databases.

Pricing: Contact the sales team for a quote or demo.

Review: “I like that I have all of the information I need to review an order in one page. The other advantage is that our other verification systems are embedded in it so it makes it easier to toggle tasks.”

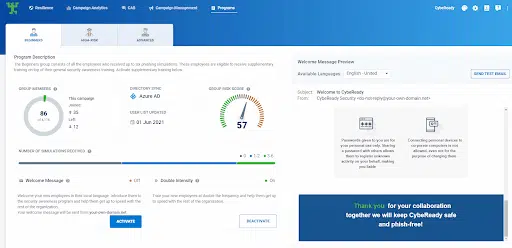

2. CybeReady

CybeReady is a non-traditional solution that focuses on creating a culture of security awareness among employees in various industries, including finance, pharma, and manufacturing. The company provides cybersecurity training and awareness programs to help organizations prevent credit card fraud and prepare for PCI compliance and audits.

By empowering employees at all levels of the organization with the knowledge to identify and prevent fraud, CybeReady helps create an extra layer of security while creating a shared sense of responsibility for the organization’s security status.

Best for: Organizations of all sizes looking to develop a security-focused company culture.

Pricing: Available upon request.

Review: “Cybeready is exactly what we needed! The whole experience has been positive from the initial sales demo through to purchase and deployment, but more importantly they have continued to be supportive and responsive to our needs and challenges. Great technology and a strong team behind the product.”

3. Cybersource

Cybersource offers four main modules to address payment fraud, all powered by Visa’s Decision Manager software. Its unified payment solution allows organizations to transition between payment models like BNPL and take on new forms of payment currency with confident fraud protection. Cybersource also has granular modules for helping merchants grow their reach, with capabilities for currency conversion, global tax compliance, and customer lifetime management.

Best for: Organizations looking to streamline or diversify payment models and scale up.

Pricing: Contact the sales team for a quote.

Review: “CyberSource features an easy and very intuitive system with a secure environment for multiple data handling and the tracking of previous project payments and other business transaction data.”

4. Ekata

Through its API solutions, Ekata provides worldwide identity verification and fraud prevention services, which include Transaction Risk API, Address Risk API, and Phone Intelligence API. Additionally, the anti-fraud provider delivers two onboarding APIs explicitly designed for fraud analysts: Merchant and Account; and the Pro Insight tool.

Best for: Organizations seeking easy integration with APIs and fraud analysts who need a powerful tool.

Pricing: Contact Ekata’s sales team for a quote

Review: “We heavily rely on the score given by Ekata, which has allowed us to reduce our review rate, false positives and catch bad actors faster and easier. The insight on emails, addresses is very comprehensive.”

5. Kount

Kount is an enterprise-grade fraud detection solution that offers everything organizations need for CNP (Card Not Present) fraud monitoring and protection. Its customizable rules automate chargeback prevention and reduce manual review time. Kount Identity Trust Global Network captures data from 32 billion user interactions annually, making it a top choice for ID verification.

Best for: Large organizations looking for a robust fraud detection solution.

Pricing: Contact for pricing

Review: “A lot of fraud and unauthorized transactions were captured. And helps minimize the losses of our company due to fraud transactions. Big thanks to Kount.”

6. SEON

SEON’s fully modular solution allows organizations to choose the modules that make sense based on their fraud risk, from transaction fraud to matched betting multi-accounting. Its machine-learning engine suggests rule changes based on a merchant’s historical data, and its reverse social media lookup feature gathers data from over 50 online signals.

Best for: Organizations looking for a customizable, modular solution.

Pricing: Starts at $299 per month

Review: “The data enrichment tools are extremely powerful and with the help of [SEON] we are able to verify users based on their digital identity.”

7. Riskified

Riskified is a fraud detection and prevention solution that uses advanced machine learning algorithms to analyze complex data sets and identify fraudulent activity in real-time. The platform supports various payment methods and offers features designed to help organizations reduce chargebacks, improve transaction approvals, and protect against evolving fraud trends.

Best for: Organizations looking for a fraud detection solution supporting multiple payment methods and real-time decision-making.

Pricing: Available upon request.

Review: “I like that Riskified tells you exactly why orders have been declined, and it explains if the same person has been recognized from a different organization previously and in what category.”

8. Sift

Sift is a fraud detection and prevention solution that uses machine-learning algorithms to analyze vast amounts of data and identify fraudulent activity in real-time. The platform offers features to help organizations reduce chargebacks, improve transaction approvals, and protect against evolving fraud trends, including comprehensive chargeback protection and dispute management services.

Best for: Online retailers and merchants looking for a comprehensive fraud detection and chargeback protection solution.

Pricing: Available upon request.

Review: “Sift has a very precise payment abuse protection product that helps us maintain a high conversion rate while minimizing risks related to fraud. The machine learning algorithm iteratively adapts to our specific environment and picks out potentially fraudulent cases with laser precision.”

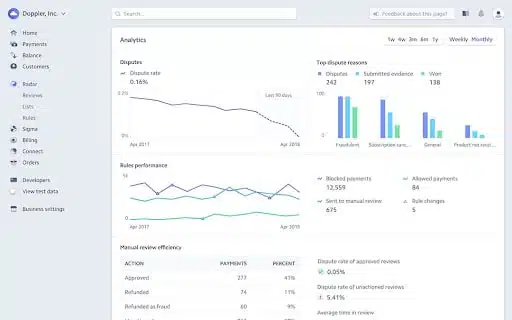

9. Stripe Radar

Stripe Radar is a popular solution that utilizes machine-learning algorithms and data from the entire Stripe network to spot real-time fraudulent activity. Its Chargeback Protection feature automates the chargeback dispute process and reimburses merchants for eligible charges. Stripe Radar also allows merchants to set customizable rules according to their needs.

Best for: Organizations of all sizes looking for customizable credit card fraud detection software.

Pricing: Request a custom quote for the enterprise plan or pay 0.4% + 5¢ per successful transaction for the “pay-as-you-go” plan

Review: “It helps in doing secure transactions/ payments all over the world. It is easy to set rules, it is very safe and it saves your data and your daily transactions from any kind of fraud or cheating . It makes me feel safe that my business is free from any kind of fraud .”

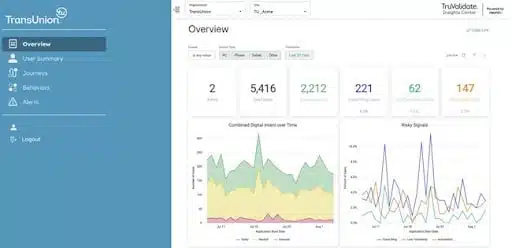

10. TruValidate

Despite undergoing several name changes, TruValidate (formerly known as TransUnion and Lovation) has been a trusted iGaming fraud prevention specialist since 2004. Their product offerings include device recognition technology, which facilitates user authentication, a customizable authentication solution, document verification via their proprietary database, and biometric verification.

Best for: iGaming brands looking for a well-known vendor.

Pricing: Available upon request.

Review: “[TruValidate] is easy to use. I like the reporting features and ease of use with pulling data in the tool. The business rules editor could be more user friendly.”- G2

Preventing Fraud With Awareness

Credit card fraud detection solutions are essential for organizations that process credit card transactions. They can help prevent fraudulent activities, reduce chargebacks, and mitigate the financial impact of fraudulent behavior. When choosing a credit card fraud detection solution, it is important to consider critical features such as real-time detection capabilities, the ability to analyze large volumes of data, and seamless integration with other systems and platforms.

In addition to choosing the right fraud prevention solution for your organization, building cybersecurity awareness among your employees is critical for early identification and prevention of potential fraud attacks. CybeReady offers employee awareness training that gives employees at all levels a shared sense of responsibility, making your organization more resilient to fraud and cyber threats.

Schedule a free demo with CybeReady today to learn how you can get started.