Our digital era has ushered in a wave of convenience and innovation, especially within the European Union’s (EU) financial sector. However, every step forward seems shadowed by looming threats—cyberattacks grow in sophistication and frequency, threatening the integrity of financial systems and the trust of millions who depend on them. As recent breaches show, the damage includes massive financial losses.

Statistics reveal a disturbing trend: In 2023, data breaches came with a hefty average price tag of $4.45 million—a jump of 15% in just three years. As a prime target, the financial sector felt the brunt, with costs surging to an alarming USD 5.97 million per breach. With cyber attacks the unfortunate “new normal” in business and eCommerce, these figures underscore the urgency for a cohesive defensive posture and cyber resilience strategy.

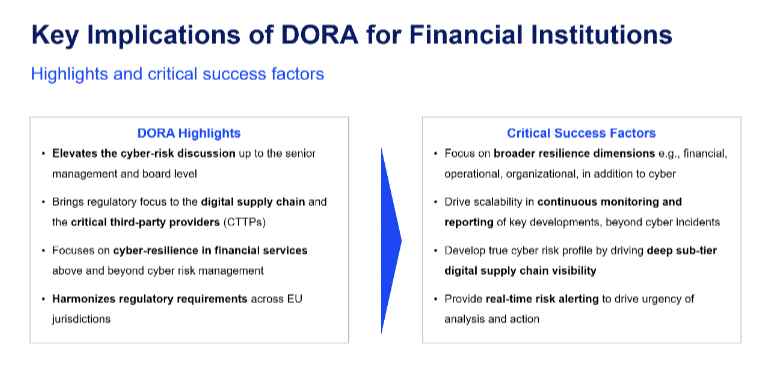

Enter the Digital Operational Resilience Act (DORA). This visionary directive from the EU is more than just another financial sector compliance checklist—it’s a comprehensive blueprint designed to fortify the EU’s financial entities against the multifaceted challenges of today’s cyber landscape. Beyond its protective mandate, DORA also seeks to ensure the sector’s continuity and recovery capabilities in the face of information and communication technology (ICT) disruptions.

Dive into this post as we demystify DORA’s framework, highlighting its pressing relevance in our interconnected age. You’ll gain insights into its key pillars, who it impacts, how it relates to cyber resilience, its challenges, and the dates you need to know. We’ll also provide a deeper understanding of how to achieve DORA compliance, and the challenges involved, provide actionable steps to compliance, and let you know how CybeReady can help.

Our goal: To ensure your organization doesn’t just comply with DORA but thrives under its protective umbrella. Read on and join us in this journey towards a more resilient financial future as we explore DORA.

Jump to:

The Digital Operational Resilience Act (DORA) is a regulatory initiative introduced by the European Union on 28 November 2022. It addresses the growing need for standardized cyber resilience measures within the financial sector.

The core objectives of DORA are:

The Digital Operational Resilience Act’s introduction comes at a time when the financial sector’s increasing reliance on ICT has exposed it to greater vulnerabilities. DORA seeks to reduce the systemic risks posed by cyber threats to the European financial ecosystem by ensuring financial entities can effectively respond to and recover from potential disruptions.

DORA’s jurisdiction spans traditional financial institutions, pivotal third-party service providers, and even some unconventional entities. The act’s essence is rooted in its enforceability across the EU, complementing the Network and Information Security (NIS2) directive and aligning with the GDPR’s ethos of safeguarding sensitive personal data.

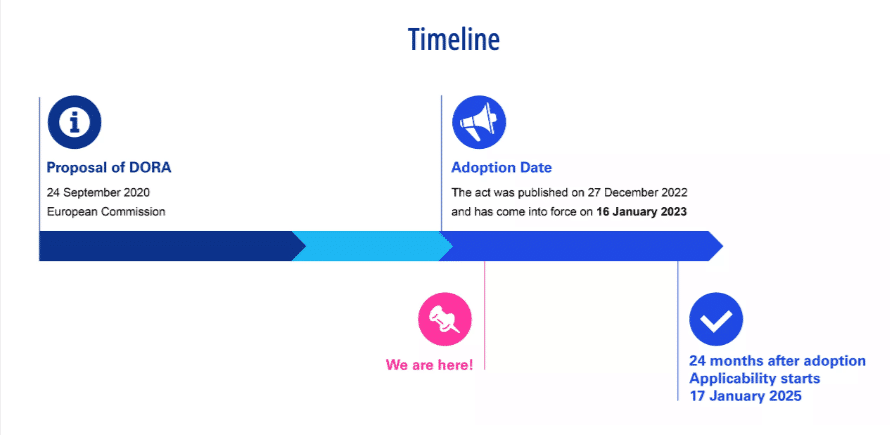

Here’s a breakdown of the pivotal dates associated with the Digital Operational Resilience Act:

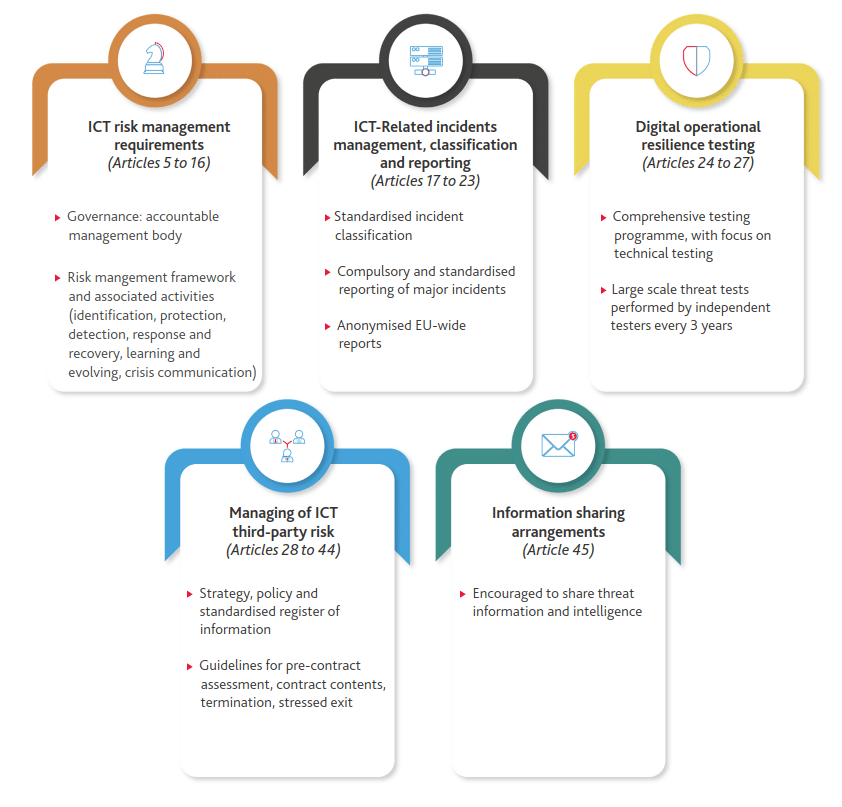

DORA outlines a comprehensive strategy to bolster cyber resilience, built upon five core pillars. These principles serve as more than just regulatory requirements; they act as fundamental guidelines to establish a fortified financial sector in the face of potential ICT challenges.

DORA’s foundational pillars are:

Beyond merely addressing ICT risks, it’s pivotal to integrate them into organizational governance. Both institutions and CTPS should adopt an all-encompassing framework that pinpoints and manages these risks, ensuring a seamless and effective monitoring mechanism.

In the event of setbacks, transparency takes precedence. An onus is placed on both financial institutions and CTPS to swiftly communicate significant ICT-related anomalies. This requirement ensures relevant authorities are updated about the incident’s specifics, subsequent implications, and corrective measures taken.

Stagnation can jeopardize an entity, so regular resilience assessments become indispensable. Through such evaluations, potential weak spots can be identified, guiding institutions and CTPS in strengthening their ICT safeguards.

Given the interdependence on third-party providers, financial institutions must be prudent. DORA underscores the importance of meticulous risk evaluations with these external parties, ensuring defined contractual terms that lay out respective roles and responsibilities.

Pooling knowledge in the aftermath of disruptions can pave the way for fortified defenses. DORA encourages institutions and CTPS to disseminate information regarding ICT disruptions among peers and authoritative bodies. This collaborative approach aims to enhance collective security measures, uplifting the resilience of the entire sector.

The five pillars provide DORA with a systematic approach, laying down a path to ensure that the financial infrastructure remains steady, adaptable, and resilient against ICT challenges.

Cyber resilience is an organization’s capacity to proactively defend against, adeptly respond to, and rapidly recover from cyber threats. It pivots on principles like prevention, detection, response, recovery, and adaptation.

The Digital Operational Resilience Act’s emphasis on harmonized rules across the EU seeks to instill a consistent, high standard of cyber resilience among all financial entities. Its specific focus on robust ICT risk management embodies the principles of prevention and detection in cyber resilience. The act’s mandate on reporting significant ICT-related incidents aids in timely response and provides valuable insights for future adaptation.

DORA pushes entities to continually assess and enhance their cyber defenses through regular digital testing. The oversight of third-party ICT service providers ensures that the entire ecosystem remains resilient, highlighting the interconnectedness of today’s digital infrastructures.

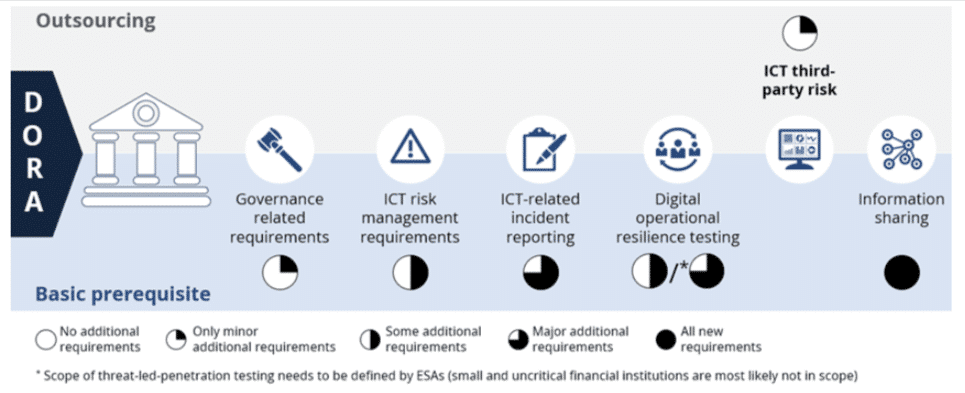

Here’s a closer look at the kinds of EU financial organizations that come under DORA’s umbrella and the potential impacts of implementing the directive:

This group encompasses banks, insurance companies, investment firms, and even crypto-asset service providers.

These are entities offering essential IT and cybersecurity services to financial firms.

Organizations that might not traditionally be categorized as financial institutions or CTPSs but come within DORA’s regulatory scope due to their specific ICT services.

Navigating the complex landscape of complying with the Digital Operational Resilience Act compliance necessitates a holistic and strategic approach for organizations. But there are some things you can do to prepare.

At its core, understanding DORA’s stipulations is paramount, which means diving into its provisions and guidelines. Organizations need to assess their current ICT risk landscape to position themselves effectively and chart out a precise compliance trajectory.

A significant aspect of this journey is creating and continuously refining a digital operational resilience strategy, which should be underpinned by an understanding of the cyber risks threatening the organization. Tools like penetration testing and threat intelligence are crucial in illuminating vulnerabilities and fortifying defenses.

Furthermore, collaboration across various teams—from IT security to legal and compliance—is essential to obtain a panoramic view of cyber risks and ensure robust compliance. Engaging with third-party service providers also requires a heightened focus on ICT-related dependencies and potential risks.

The organization’s leadership bears significant responsibility—not only do they drive the implementation of DORA requirements, but they also foster a security-centric organizational culture. This means both senior executives and every team member play a role in maintaining security.

Another linchpin in this endeavor is transparency. Organizations are urged to promptly disclose ICT-related incidents, contributing to a more resilient financial ecosystem. Equally essential is the readiness to furnish evidence of compliance and the agility to recalibrate strategies based on insights from past incidents and evolving cyber risks.

Below, we outline the challenges you can expect to face, the steps to take to become DORA compliant, and offer two solutions that will ease the process—a DORA Compliance Checklist and CybeReady.

The inception of the Digital Operational Resilience Act is a pivotal moment in enhancing digital stability within the financial realm. But, like all new rules, compliance has its challenges:

Navigating DORA compliance can initially seem complex, but with a systematic approach, it’s manageable. Let’s walk through twelve steps that will help your organization become compliant with the Digital Operational Resilience Act:

Firstly, acquaint yourself with DORA’s requirements for your organization. Once you know what’s required, you can ensure the construction of a compliant cyber resilience framework. Specialized courses like the DORA Certified Compliance Specialist (DCCS), can provide an added layer of expertise.

Perform a holistic risk assessment across your organization, extending to your supply chain. Utilizing automated solutions can be invaluable in pinpointing vulnerabilities to cyber threats.

Pooling insights from various teams—IT, compliance, legal, risk management, and external stakeholders—provides a multifaceted perspective on potential cyber risks. This collaborative effort is essential to craft a robust and encompassing compliance strategy.

DORA compliance requires digital operational resilience training for all members of the organization. Ensuring an organization’s resilience is a responsibility that falls on top-tier executives, making them essential to integrating DORA’s requirements. Tailored training for each employee, based on their functions and responsibilities, is vital. Training programs from CybeReady are an ideal solution to creating cybersecurity awareness across the organization.

DORA necessitates a cyber resilience strategy in accordance with DORA Article 6(8). Your business continuity plan should comprehensively detail response mechanisms to cyber threats, data breaches, and operational disruptions.

Considering DORA’s stipulations include third-party service regulations, integrate them into both your risk assessments and resilience strategy. Analyze the complexity and magnitude of ICT services, understanding your organization’s dependencies.

Undertaking penetration tests every three years is a DORA mandate. Employing Pen tests and Digital Operational Resilience Testing (DORT) enables you to identify and counteract risks by simulating real-world threats.

Continuous compliance with DORA requires sophisticated detection tools for breaches, anomalies, or cyber-attacks. Automating threat detection, as detailed in DORA’s Article 10, ensures timely alerts and responses.

Feedback from resilience tests and historical attack data can provide vital insights. Periodically revisiting and refining your strategy ensures its efficacy and relevance in a dynamic cyber landscape.

Sustained DORA compliance requires forward thinking. Prioritize remediation steps by discerning vulnerabilities, then strategize solutions considering their potential impact and likelihood.

Robust technical and organizational measures are non-negotiable in safeguarding client data. Adherence to regulations applicable to EU Member States, notably the GDPR, is fundamental.

Document your commitment through routine tests and simulated threat assessments. Being equipped to readily furnish evidence of resilience tests showcases your organization’s dedication to data safety and security. Tools like CybeReady’s AuditReady are instrumental for compliance reporting.

To simplify your organizational compliance with the Digital Operational Resilience Act, download our free DORA Compliance Checklist [XLS].

Digital Operational Resilience Act compliance requires a thoughtful approach and the right resources. Institutions often grapple with grasping the expansive scope of DORA and setting up a robust ICT system. In this context, CybeReady stands out as a vital ally for businesses.

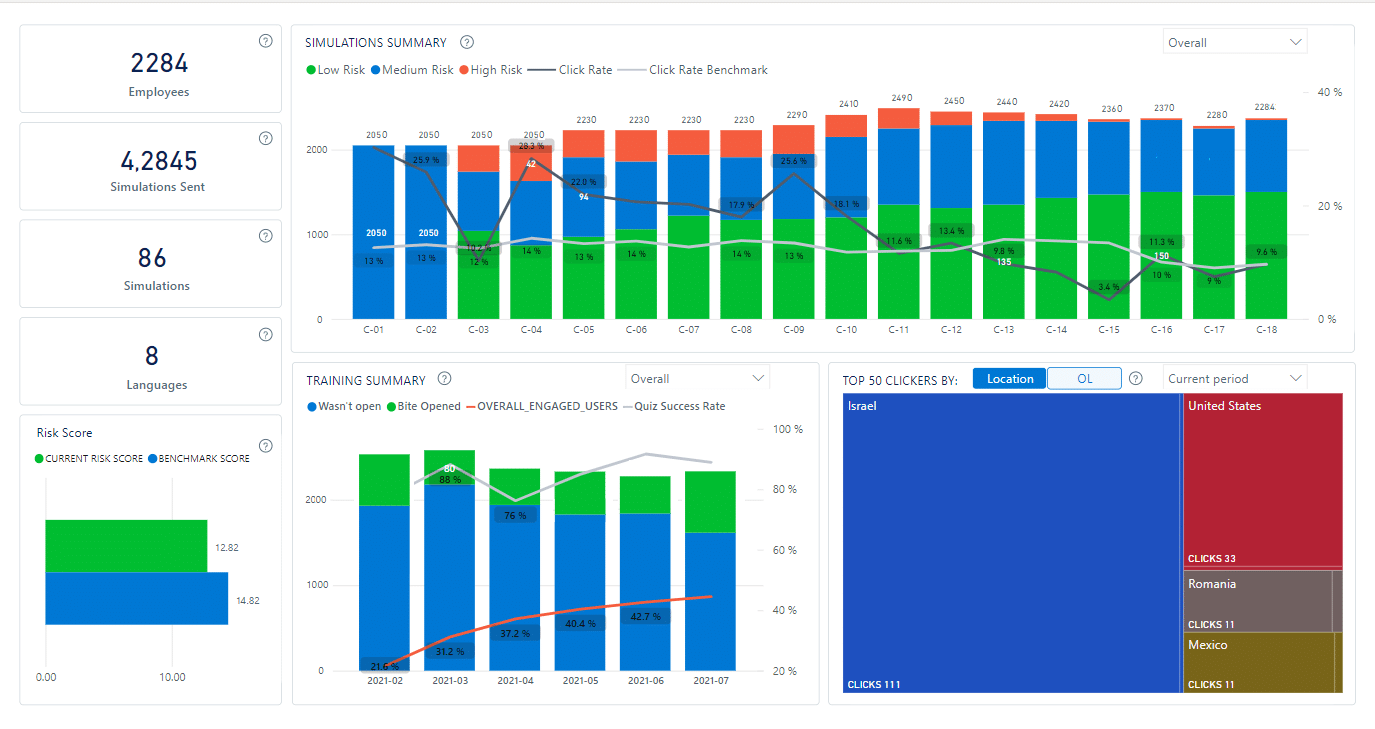

CybeReady’s employee cybersecurity awareness training is crafted to tackle essential compliance issues. The platform caters to a wide array of requirements, equipping your team with skills for quick incident handling, overseeing third-party risks, and elevating the overall security consciousness of employees.

Moreover, our AuditReady tool gears up your organization for detailed cybersecurity evaluations and produces on-the-spot compliance documents, ensuring you’re consistently prepared to demonstrate proof of DORA’s training criteria.

The Digital Operations and Resilience Act implementation phase is underway, ushering in major shifts for EU financial entities and related organizations. Adhering to DORA will bolster the security and reliability of the financial infrastructure, while failures to comply could lead to substantial fines.

If you’re concerned about how ready your organization is for DORA, CybeReady offers assistance to help you prepare. Reach out for a demo to see how our training and solutions can fortify your organization’s cyber resilience and set you on the path to successful compliance.

Copyright © 2025 – CybeReady

We will reach out to you shortly.

In the meantime, please check out our complimentary CISO Tool Kit

Wir werden uns in Kürze bei Ihnen melden.

Schauen Sie sich bitte in der Zwischenzeit das kostenlose CybeReady CISO Tool Kit an.

We will reach out to you shortly.

In the meantime, please check out our complimentary CISO Tool Kit, or visit Our Blog

We will reach out to you shortly.

In the meantime, please check out our complimentary CISO Tool Kit, or visit Our Blog